Maximizing Business Opportunities Through Financial Services

In today’s competitive market, understanding the nuances of financial services is crucial for the success of any business. From navigating tax obligations to optimizing financial strategies, the role of accountants and tax professionals cannot be overstated. One term often associated with financial optimization is cwlb, which stands for a comprehensive approach to financial literacy and management. This article will delve into various aspects of financial services, highlighting how they contribute significantly to business growth.

The Importance of Financial Services

Financial services encompass a broad range of activities that support the management of money and assets within a business. Understanding these services is paramount for making informed decisions that lead to efficiency and growth. Here are the core areas covered under financial services:

- Accounting: Keeping track of financial records, ensuring compliance with laws and regulations.

- Tax Services: Navigating tax implications, preparing tax returns, and offering strategies to minimize liabilities.

- Consulting: Providing expert advice to improve financial performance and business operations.

Understanding Accounting Services

Accounting forms the backbone of any financial operation in a business. It involves the systematic recording, reporting, and analyzing of financial transactions. Here are the key benefits of incorporating robust accounting practices:

1. Accurate Financial Reporting

Regularly updated accounting books ensure that the financial statements reflect the true and fair view of the business's financial health. This is crucial for stakeholders who make informed decisions based on these reports.

2. Informed Decision-Making

Effective accounting practices provide a solid foundation for making informed and strategic business decisions. By analyzing past performance, businesses can identify trends and forecast future growth.

3. Enhanced Funding Opportunities

Lenders and investors prefer businesses with organized financial records. Having professional accounting services boosts the credibility of a business when seeking loans or investments.

Tax Services: Navigating Complex Regulations

Taxation can be a complex landscape filled with regulations that continually evolve. Partnering with professionals who offer tailored tax services can help businesses stay compliant while optimizing their tax positions. Here’s why tax services are invaluable:

1. Preventing Costly Mistakes

Tax professionals can help identify deductions and credits that a business may qualify for, ensuring that they do not overpay on taxes. This meticulous attention to detail can save substantial amounts.

2. Tax Planning and Strategy

Effective tax planning is not a one-time event; it’s a year-round strategy that adjusts according to business growth and regulatory changes. Tax service providers help businesses to develop a cohesive plan that supports their long-term objectives.

3. Representation and Audit Support

In the event of an audit, having experienced tax professionals by your side can provide peace of mind. They ensure proper representation and help navigate any complexities involved in the audit process.

Leveraging Financial Consultants

In addition to accountants and tax services, engaging a reliable financial consultant can bring external insights and expert recommendations. The value they provide includes:

1. Business Strategy Development

Consultants analyze market trends, operational efficiencies, and customer needs to help businesses formulate effective strategies that lead to growth and sustainability.

2. Risk Management

Effective risk management strategies are imperative for mitigating potential losses. Financial consultants help identify areas of vulnerability and develop strategic responses.

3. Financial Literacy Training

Beyond offering direct services, many consultants provide training to staff members, enhancing the overall financial literacy of the organization which, in turn, improves overall fiscal responsibility and decision-making.

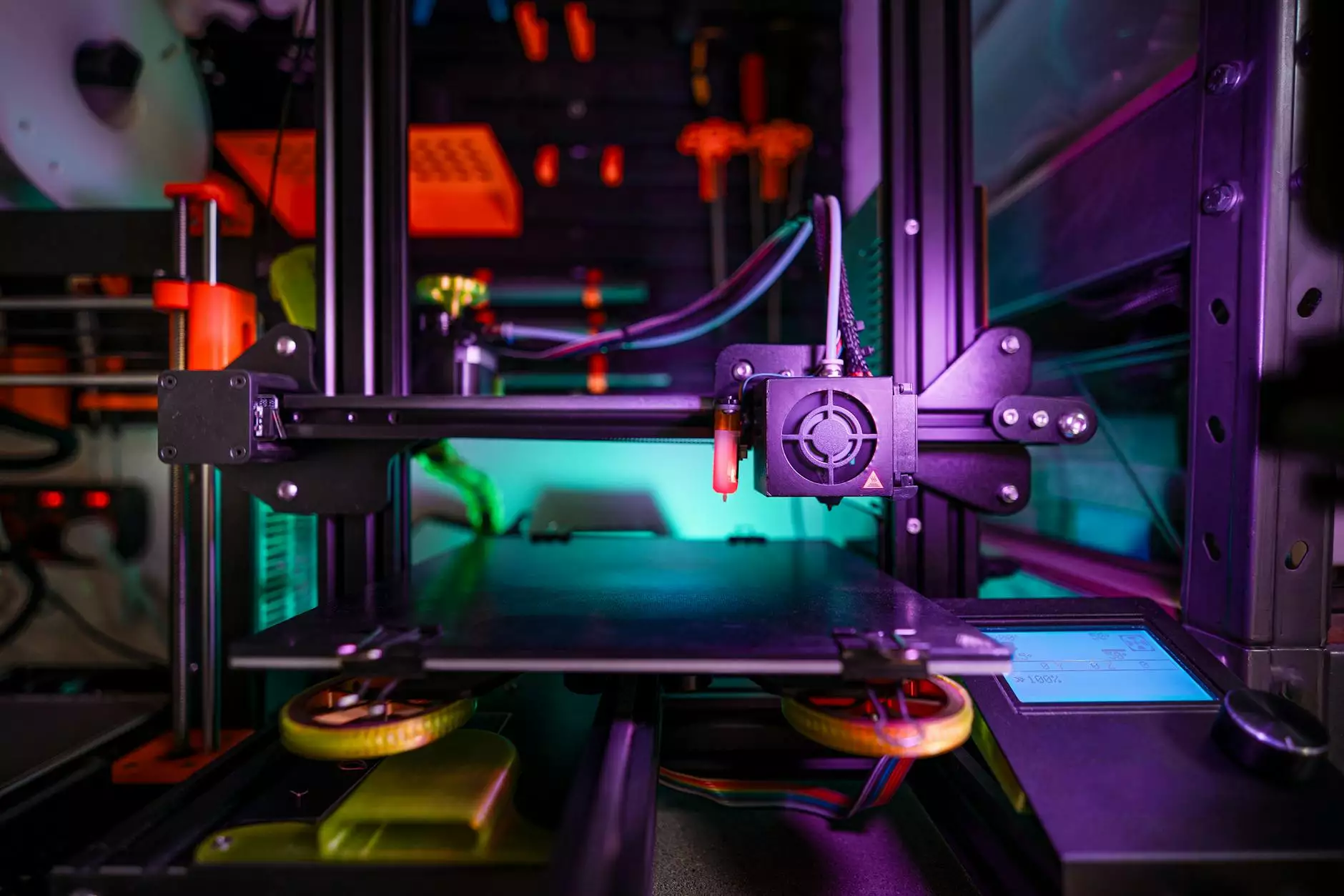

The Role of Technology in Financial Services

As we embrace the digital age, technology continues to revolutionize financial services. Tools and platforms make it easier to manage finances, enhance reporting accuracy, and streamline tax preparations. Here are a few technological advancements that businesses can leverage:

- Accounting Software: Programs like QuickBooks and Xero enable businesses to manage their accounts efficiently through automated processes.

- Cloud Computing: Cloud-based accounting solutions facilitate real-time access to financial data from anywhere, enhancing collaboration.

- Data Analytics: Utilizing data analytics helps businesses gain insights into trends and customer behavior, thereby driving smarter financial decisions.

The Future of Financial Services

As the business environment continues to evolve, so too will the landscape of financial services. Businesses must stay abreast of changes to remain competitive. The following trends are expected to shape the future of financial services:

1. Increased Use of Artificial Intelligence

AI will play a significant role in automating routine tasks, providing predictive analytics and enhancing customer interactions, leading to greater efficiency.

2. Personalized Financial Services

Consumer expectations are shifting towards more personalized services. Financial advisors will leverage data to offer customized strategies tailored to individual business needs.

3. Regulatory Changes

Businesses must stay nimble and ready to adapt to new regulations which can arise from economic changes, making continuous education and expert support essential.

Conclusion: Your Partner in Financial Success

In conclusion, understanding and utilizing financial services is not just an option, but a necessity for businesses aiming for longevity and success. Through proper accounting, tax management, and strategic consulting, businesses can unlock potential growth pathways. Embracing technology and remaining aware of emerging trends will equip organizations to face challenges head-on and capitalize on opportunities.

Integrate cwlb within your financial strategies to ensure your business thrives in this fast-paced environment. Remember, effective financial management is the cornerstone of successful business operations and sustainability.

For exceptional financial services tailored to your business's needs, consider partnering with taxaccountantidm.com. Their expertise across various financial domains promises to lead your business towards a prosperous future.